What is Sarbanes-Oxley Act (SOX) Section 404?

What is Sarbanes-Oxley Act (SOX) Section 404?

The Sarbanes-Oxley Act (SOX) of 2002 was a landmark piece of legislation enacted in response to major accounting scandals that shook investor confidence in the early 2000s. A central component of this sarbanes oxley act, Section 404 addresses the critical need for robust internal controls over financial reporting in publicly traded companies. This article provides a comprehensive overview of sox section 404, its requirements, challenges, and benefits, along with practical guidance for sox 404 compliance. This article helps to understand what is sox 404.

What is SOX 404?

SOX 404, also known as Sarbanes Oxley 404, mandates that all publicly traded companies, referred to as SEC issuers (companies with securities registered under Section 12 or 15(d) of the Securities Exchange Act of 1934), must establish, document, test, and maintain internal controls and procedures for financial reporting. The core objective is to reduce the risks of corporate fraud and improve the accuracy and reliability of financial statements disclosures by enhancing the rigor of financial reporting methods and regulations. This helps to ensure that companies are managing their financials effectively.

Specifically, sox section 404 has three key subsections:

-

Section 404(a)

Section 404(a) requires management of all public issuers to conduct an annual assessment of the operating effectiveness of their company’s internal controls over financial reporting. This includes documenting internal controls and reporting the results of management’s assessment in the company’s Form 10-K. Management is responsible for establishing an adequate internal control structure and procedures for preparing financial statements.

-

Section 404(b)

Section 404(b) mandates that an independent auditor attest to, and report on, management’s assessment of its internal controls. This independent auditor should not be part of the company’s internal audit committee. The auditor’s opinion on the company’s internal controls is also reported in the audit report section of the Form 10-K. The Public Company Accounting Oversight Board (PCAOB) sets the rules for these audits.

-

Section 404(c)

Section 404(c) provides exemptions to certain organizations from the auditor attestation requirements of section 404(b). These exemptions are primarily for “non-accelerated filers” (companies with a public float of less than $75 million) and “emerging growth companies” (EGC) with total annual gross revenue of less than $1.235 billion in the most recent fiscal year. Note that EGC thresholds can change periodically and require checking for the current values.

The Purpose and Scope of SOX 404

The primary purpose of sarbanes oxley act section 404 is to ensure that financial statements are reliable and free from material misstatements. This is achieved through a top-down risk assessment approach. The management is responsible for assessing and confirming that the internal controls are designed effectively and operating as intended. This process is a key component of sox compliance.

Key Requirements of SOX Section 404

Management Responsibility:

Management is responsible for establishing and maintaining an adequate internal control structure and procedures for financial reporting. At the end of each fiscal year, management must assess the effectiveness of these controls using a suitable and recognized control framework, such as the framework developed by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

Internal Control Report:

Each annual report must include an Internal Control Report stating management’s responsibility and an assessment of the control structure’s effectiveness. Any identified shortcomings in these controls must also be reported.

Auditor’s Attestation:

External auditors must attest to the accuracy of management’s assessment that internal accounting controls are in place, operating, and effectively, except in cases of exemption as defined in section 404(c).

Documentation:

Companies must maintain documented evidence of the design and operation of their internal controls. Following documentation process is required to ensure sox 404 compliance.

-

Annual Assessment:

The internal control assessment is an annual requirement, and controls must be evaluated and updated regularly.

-

Addressing Deficiencies:

Any identified control deficiencies must be evaluated to determine if they constitute a “material weakness” – a deficiency that creates a reasonable possibility of a material misstatement in the financial statements. If material weaknesses exist, they must be reported, and plans to address them must be outlined in the report.

Challenges of SOX 404 Compliance

Implementing sox 404 compliance can be complex and challenging, particularly for smaller companies. Common difficulties include:

- Cost: The added resources and personnel costs involved in implementation, documenting, and monitoring an internal control framework can be substantial. This includes employing subject matter experts, external consultants, or hiring a public accounting firm.

- Time: The development of an internal control framework is time-consuming, requiring careful identification, design, documentation, implementation, and ongoing monitoring of controls.

- Documentation Complexity: Detailed documentation is crucial for proving the effectiveness of internal controls, requiring time and expertise.

- Maintaining Precision: Setting the correct “precision” for each control (the monetary threshold that triggers a review) is critical. If set too low, controls are inefficient; if set too high, they become ineffective.

- Continuous Monitoring: The internal control framework must be reviewed, updated, and tested continuously to ensure ongoing effectiveness and address changes within the organization.

Steps to SOX 404 Compliance

To achieve sox 404 compliance, companies should take the following steps:

Identification:

Identify all key processes that impact financial reporting and perform a risk assessment of each, creating risk matrices for all processes such as revenue, procurement, and related-party transactions.

Design and Documentation

Design and document each control, including who performs it, how often, what documentation is required, and the level of precision.

Implementation

Implement the designed controls, providing added time to employees to perform and document controls effectively.

Monitoring:

Continuously review and update the internal control framework, making changes as an organization grows and business practices evolve, this is key for maintaining sarbanes oxley 404 compliance.

Benefits of SOX 404 Compliance

While sox 404 implementation presents challenges, the benefits are substantial:

- Improved Financial Reporting: Reduces the risks of errors and misstatements in financial reporting.

- Enhanced Investor Confidence: Increases investors confidence that financial statements are accurate and reliable.

- Stronger Internal Controls: Mitigates the risk of material errors going undetected.

- Defined Responsibilities: Clearly defines employee roles and responsibilities, improving work performance and reducing turnover.

- Improved Business Understanding: Enhances both management and employees’ understanding of business operations.

- Reduced Audit Adjustments: Minimizes the number of audit adjustments from external auditors.

- Reduced Fraud Risk: Mitigates the risk of fraudulent related-party transactions and overall corporate fraud.

- Improved Corporate Governance: Strengthens corporate governance and overall operational integrity.

- Increased Transparency: Provides additional transparency to the board of directors regarding financial reporting.

- Better Data Integrity and Cybersecurity: Strengthens data integrity and cybersecurity to minimize the threat of cyber and ransomware attacks.

- Standardized Accounting Procedures: Provides standardized accounting and finance procedures for multi-national organizations.

Automating SOX 404 Compliance

Given the challenges, Appsian’s sox management software can help to reduce implementation time, costs, and ongoing monitoring requirements. Automated platforms aid in building and scaling internal controls, streamlining compliance efforts. Sox 404 audit processes are greatly improved with automation.

Conclusion

Sarbanes Oxley section 404 is a vital component of the sarbanes oxley act, designed to improve the accuracy and reliability of financial reporting by publicly traded companies. While compliance can be complex and challenging, the benefits of robust internal controls are substantial. By implementing a well-designed internal control framework and actively monitoring its effectiveness, companies can mitigate fraud risks, improve financial reporting, and enhance investor confidence. It is imperative that companies, even those exempt from section 404(b), take their section 404(a) requirements seriously, as failure to do so can lead to serious penalties. Section 404 of the sarbanes-oxley act requires companies to: establish effective sox 404 controls. Section 404 of the sarbanes-oxley act requires continuous assessment, which should be included in an annual report. This entire process of sox 404 is crucial for maintaining internal control over financial statements. Section 404 sox is most effectively handled through diligent testing and evaluation, using internal resources and external auditors as needed.

Put the Appsian Security Platform to the Test

Schedule Your Demonstration and see how the Appsian Security Platform can be tailored to your organization’s unique objectives

Comprehensive Guide to SOX Compliance

What is the Sarbanes-Oxley (SOX) Act?

Sarbanes-Oxley Act (SOX) is a landmark legislation enacted by the United States Congress in 2002 that requires all public companies traded on U.S. stock exchanges to follow strict rules for financial reporting, ensuring accuracy and integrity of financial information disclosures.

What is SOX compliance?

SOX compliance is a set of processes and activities that ensure an organization is following the principles and requirements prescribed in the SOX act.

History of SOX

In 2001-2002, Wall Street was rocked by a string of corporate scandals, all related to improper financial disclosures. These scandals wiped out billions of dollars of investors’ and employees’ funds, shook public confidence, and created a need for better regulation of financial reporting. Just the two largest failures, Enron and WorldCom, lost over $250 billions of investors’ money and filed for bankruptcy.

To prevent fraudulent and misleading financial practices, the Sarbanes-Oxley Act (SOX), named after Senator Paul Sarbanes and Representative Michael G. Oxley, was enacted in 2002. The Act standardized financial reporting practices by mandating strict internal controls, increasing auditor independence, and establishing both civil and criminal liability for C-suite executives based on their attestation of financial disclosures. In addition, SOX created the Public Company Accounting Oversight Board (PCAOB) – a nonprofit organization whose main function is to regulate and oversee the accounting firms that conduct SOX audits; it audits the auditors.

Why SOX Compliance Matters

Organizations that are SOX compliant – i.e., follow practices that ensure accuracy, integrity, and transparency in their financial reporting – improve trust with shareholders, avoid potential legal repercussions of non-compliance (which may include civil and criminal liability and substantial fines), and improve their risk and cybersecurity postures.

Overview of the Sarbanes-Oxley Act

The enactment of SOX has had a significant impact on corporate governance, financial transparency, and investor confidence. By mandating rigorous practices in financial reporting, internal controls, and risk management, and introducing personal responsibility of the executives for accuracy and transparency in financial reporting, SOX restored public confidence, reduced corporate fraud, and improved accuracy in financial disclosures.

Key Provisions of SOX

Following are the key provisions of SOX Compliance:

- Creating the Public Company Accounting Oversight Board (PCAOB)

- Strengthening Financial Reporting Requirements

- Making Corporate Executives Personally Responsible for Financial Disclosures and Controls

- Increasing Independence for External Auditors and Analysts

- Protecting Whistleblowers

Creating the Public Company Accounting Oversight Board (PCAOB)

Section 101 of the SOX Act mandates the creation of a non-profit organization – the Public Company Accounting Oversight Board (PCAOB) – that oversees standards and requirements for organizations conducting external SOX compliance audits of compliant entities.

Strengthening Financial Reporting Requirements

SOX mandates companies to implement effective internal controls over financial reporting, ensuring data integrity and transparency in financial disclosures. It also requires organizations to undergo assessment of the effectiveness of such controls and immediately disclose any material changes to financial reports and control deficiencies.

Making Corporate Executives Personally Responsible for Financial Disclosures and Controls

Under SOX, corporate executives are personally responsible for the accuracy and completeness of financial disclosures. There are two sections of the Act dealing with that: Section 302 requires CEOs and CFOs to personally certify the disclosures and introduces civil penalties, while Section 906 introduces criminal liability for knowing or willful non-compliance.

Increasing Independence for External Auditors and Analysts

Section 201 of SOX imposes strict rules on external auditor independence, prohibiting them from providing certain non-audit services to organizations to prevent conflicts of interest. These prohibited services include financial services, investment consulting, recruiting, accounting, services related to audit processes, and any services that PCAOB deems prohibited. In addition, Section 301 mandates that audit committees must operate independently, which ensures the objective nature of their assessments.

Protecting Whistleblowers

SOX Sections 806 and 1107 specifically provide protection for employees or persons who provide truthful information to federal authorities about deficiencies or fraud in financial reports. These protections safeguard against retaliation and harassment and include remedies such as reinstatement and back pay.

Who Must Comply with SOX?

Regulatory obligations for SOX compliance apply to all US publicly traded companies and their subsidiaries. The SOX act also requires all international companies traded on US stock exchanges to abide by the same strict rules of financial reporting.

Private Companies and Non-profit Organizations

While private companies and nonprofit organizations are not required to be SOX compliant, many choose to implement its core principles, especially those working with public companies, preparing for IPOs, or seeking to improve their risk management and governance practices.

Accounting Companies

Accounting firms providing auditing services to public companies must be SOX compliant and adhere to PCAOB oversight, ensuring integrity and accuracy of their audits.

Key SOX Compliance Requirements

Filing Accurate Financial Reports Certified by Corporate Executives

Section 302 requires CEOs and CFOs to review and certify the accuracy and completeness of financial reports, holding them personally accountable for any misstatements or discrepancies.

Implementing Appropriate Internal Controls

Section 404 mandates organizations to establish and maintain internal controls over financial reporting (ICFRs) and conduct thorough, continuous assessments of these controls. These controls fall into two main categories as follows:

| Business Process Controls | IT Controls |

| Controls governing material financial information | Controls governing IT systems that enable financial reporting accuracy, integrity and availability |

Let’s look at each of the following in detail.

Business Process Controls

Companies must analyze their operations to identify risks and implement appropriate controls across all areas that affect financial reporting. This includes key business processes such as purchasing, payroll, revenue recognition, logistics, accounts payable/receivable, inventory management, asset management, treasury operations, and other operations that can materially impact the organization’s financial statements.

IT Controls

IT controls under SOX require organizations to establish effective processes that govern systems affecting financial reporting. Organizations can implement these controls using established frameworks such as COBIT, ISO 27001, or NIST to ensure systems align with best practices and can be easily harmonized with SOX requirements.

Real-Time Disclosure of Financial Changes

Section 409 requires companies to disclose material changes to their financial condition or operations within four business days of occurrence. This ensures timely disclosure of events that could significantly impact the company’s financial reporting.

Passing Regular Audits

SOX compliance, specifically Section 404(b), requires passing regular internal and external audits, assessing effectiveness of internal controls over financial reporting and ensuring data integrity to enable complete and accurate financial disclosures.

SOX Compliance Benefits

SOX compliance provides significant organizational benefits including enhanced risk management, increased stakeholder trust, improved financial reporting accuracy and strengthened internal controls.

Financial Stewardship

SOX compliance fosters financial stewardship by ensuring accuracy and transparency in financial reporting, enables better planning and resource allocation, and allows companies to better align financial operations with their strategic goals.

Improved Reporting

As a direct result of established internal controls over financial reporting, organizations gain better insight into their operations and can make better-informed decisions, relying on more accurate and readily available data.

Enhanced Cybersecurity

SOX requires companies to establish and maintain IT General Controls (ITGCs) that ensure security, integrity and availability of corporate systems and data, greatly improving overall security posture. Popular frameworks such as COBIT or ISO 27001 are commonly used to implement ITGCs.

Better Collaboration

Establishing SOX compliance requires organizations to create interdepartmental committees that work on implementing and maintaining internal controls and coordinate cross-functional compliance efforts, improving operational efficiency and leading to better collaboration between Finance, IT, Compliance, and other organizational units.

Risk Prioritization

One of the core tasks of a SOX compliant entity is to identify, monitor and mitigate existing and emerging risks to financial reporting and internal controls, thereby improving organizational risk posture.

Challenges of SOX Compliance

SOX compliance presents significant challenges to organizations in terms of implementation costs, resource allocation and technology investments. Key challenges include:

- Expense of external audits

- Maintaining dedicated compliance staff

- Implementing control monitoring systems

- Ongoing training requirements.

SOX Key Sections

Some sections in SOX act enable us to identify the key scope of compliance requirements. Let’s have a look at each of these sections:

Section 302: Corporate Responsibility for Financial Reports

Section 302 of SOX establishes the personal responsibility of the CEO and CFO for the accuracy of the company’s financial reports. The executives must certify the following:

-

The correctness and completeness of financial statements

-

The establishment and effectiveness of internal controls and any identified deficiencies in existing controls.

Non-compliance with Section 302 can result in civil penalties including fines up to $1 million per violation, forfeiture of performance-based compensation, and prohibition from serving as an officer in a public company.

Section 303: Improper Influence on Conduct of Audits

Section 303 deals with ensuring auditor independence and prohibits any attempt to influence, coerce, or manipulate auditors in ways that may affect their objectivity and independence.

Section 401: Disclosures in Periodic Reports

Section 401 of SOX requires organizations to publish quarterly (10-Q) and annual (10-K) filings in an accurate and consistent manner. All reports must adhere to Generally Accepted Accounting Principles (GAAP) and include all material financial transactions, off-balance-sheet obligations, and financial arrangements to provide a complete picture of the company’s financial health.

Section 404: Management Assessment of Internal Controls

Section 404 requires management to establish, document, and maintain internal controls over financial reporting (ICFR). It also requires companies to establish internal audit processes to evaluate ICFR and assess their effectiveness, with both management and external auditors providing annual assessments of these controls.

Section 409: Real-Time Issuer Disclosures

Section 409 requires companies to disclose any material changes to their financial condition or operations in a rapid and current manner to protect investor interests. Companies must report these material events within four business days of occurrence.

Section 802: Criminal Penalties for Altering Documents

Section 802 mandates retention of all audit records, business documents, and audit related electronic communications for seven years and imposes criminal penalties, including imprisonment, for any intentional alteration, falsification, or concealment of documentation intended to impede federal investigations.

Section 806: Whistleblower Protection

Section 806 provides protection for employees of public companies from retaliation by prohibiting employers from discharging, suspending, threatening, harassing, or discriminating against employees who report fraudulent activities. It allows whistleblowers to file complaints with the Department of Labor within 90 days of experiencing retaliation and seek remedies including reinstatement, back pay, and compensatory damages.

Section 906: Corporate Responsibility for Financial Reports

Section 906 complements Section 302 by establishing criminal liability for CEOs and CFOs who certify financial reports. While Section 302 imposes civil penalties, Section 906 establishes criminal penalties for willfully or knowingly false certifications. Executives face fines up to $5 million per violation and up to 20 years’ imprisonment for willful violations, or up to $1 million- and 10-years imprisonment for known violations.

Section 1107: Retaliation Against Informants

Section 1107 complements Section 806 by extending protection from retaliation to any person providing truthful information to law enforcement about federal offenses, establishing criminal penalties that can result in fines and up to 10 years imprisonment.

SOX Equivalents in Other Countries

Following the US lead, several countries introduced similar regulations aimed at improving transparency in financial reporting and safeguarding investors from fraudulent practices. Some of the most prominent examples include the UK Corporate Governance Code, Canada’s NI 52-109, Germany’s DCGK, Australia’s CLERP 9, and Japan’s J-SOX – each enacting legislation that closely mirrors the US framewor

Implementing SOX Compliance Program

Successfully implementing a SOX compliance program requires significant organizational commitment and establishment of key oversight committees to ensure proper governance and risk management.

Audit Committee

Composition

Independent members of the Board of Directors and at least one qualified Financial Expert with experience in financial reporting or auditing.

Responsibilities

-

Monitor risk management processes.

-

Oversee compliance framework implementation.

-

Ensure integrity of financial reporting.

-

Oversee both internal and external audit processes.

-

Select and monitor independent auditors.

SOX Compliance Committee

Composition

Chief Financial Officer (CFO), Chief Risk Officer (CRO), Chief Information Officer (CIO) or key IT Managers, Internal Audit Representatives, Legal and Compliance Officers, Key Process Owners (Finance, Procurement, HR)

Responsibilities

-

-

Oversee the implementation of the SOX compliance program.

-

Establish, maintain, and monitor the internal control framework.

-

Ensure all SOX-related documentation, testing, and reporting requirements are fulfilled.

-

Identify and assess control deficiencies and oversee their timely remediation.

-

Coordinate and align compliance efforts across all departments and organizational units.

-

Risk Management Committee

Composition

Chief Risk Officer (CRO), senior management representatives from Finance, IT, Operations, Internal Audit, and Compliance

Responsibilities

-

Identify, assess, and develop mitigation strategies for financial and operational risks.

-

Monitor existing and emerging risks related to SOX compliance.

-

Document risk assessments and mitigation plans.

-

Report findings to the Audit Committee and SOX Compliance Committee.

Disclosure Committee

Composition

Chief Financial Officer (CFO), General Counsel, Chief Accounting Officer, Controllers, Investor Relations Officer, and key business unit leaders

Responsibilities

-

-

Review material financial and non-financial information before public disclosure.

-

Ensure accuracy and timeliness of SEC filings and press releases.

-

Evaluate significance of events requiring disclosure.

-

Support CEO/CFO certification process.

-

Internal Audit Team

Composition

Internal Audit Director, Internal Auditors with expertise in financial processes, IT controls, and risk management

Responsibilities

-

-

Test and evaluate effectiveness of internal controls.

-

Document control deficiencies and monitor remediation

-

Report findings to the Audit Committee and support external auditors.

-

SOX Compliance Checklist

By adopting one of the popular frameworks such as COBIT or ISO 27001 for ITGC companies will have most of the following fulfilled

Prevent Data Tampering

Make sure all systems containing financial data operate while ensuring data security, integrity, and availability. Systems must have comprehensive access controls based on RBAC and need-to-know principles, with audit trails and backups enabled and regularly tested.

Document Activity Timelines

Maintain detailed audit trails of all financial activities that include timestamps for all transactions and data modifications.

Install Access Tracking Controls

Implement systems that monitor and audit access to financial systems and sensitive data.

Ensure Defense Systems Are Working

Perform regular testing and updates of cybersecurity defense systems, such as endpoint protection, firewalls, IPS and similar controls.

Collect and Analyze Security System Data

Make sure Audit Trails are not only collected, but also analyzed, with alerts on key metrics enabled and delivered to relevant parties.

Implement Security-Breach-Tracking

Develop and implement a Security Incident Response Plan and Incident Management Procedures to document and respond to security breaches and incidents.

Grant Auditors Defense System Access

Provide auditors with evidence of security systems performing as expected and grant them access when required or requested.

Disclose Security Incidents to Auditors

Share with auditors’ documentation of security incidents and breaches, along with steps taken for remediation.

Report Technical Difficulties to Auditors

Inform auditors of any technical difficulties that affect internal controls and could impact financial reporting.

Key Steps in the SOX Audit Process

Defining a SOX Audit Scope Using a Risk Assessment Approach

Section 404 requires organizations to conduct comprehensive risk assessment to determine areas critical for financial reporting accuracy. This assessment establishes materiality thresholds and defines which business processes, systems, and controls require evaluation during the audit.

Identify SOX Controls

Organizations must evaluate controls at multiple levels to ensure comprehensive coverage of financial reporting risks. This includes assessment of entity-level controls (ELCs) governing organizational oversight, process-level controls managing daily operations, and technology controls ensuring data integrity and security.

Testing and Documentation

The audit process requires systematic testing of control effectiveness through transaction sampling and process analysis. Organizations must maintain detailed documentation of test procedures, results, and any identified control deficiencies. This documentation supports both internal review and external auditor assessment.

Deficiency Evaluation

Organizations must assess any identified control weaknesses based on their potential impact on financial reporting. Material weaknesses require immediate management attention, documented remediation plans, and disclosure in management’s annual assessment report.

Management Reporting

The process concludes with management’s formal assessment of control effectiveness, including detailed analysis of any identified deficiencies and their potential impact on financial statements. This report provides the foundation for external auditor review and stakeholder confidence in financial reporting integrity.

Familiarize Yourself with These Organizations

PCAOB

The Public Company Accounting Oversight Board (PCAOB) is a nonprofit organization established by SOX to oversee accounting firms that audit public companies and certify the effectiveness of internal controls and accuracy of financial statements.

COSO

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) framework is widely used as the standard for establishing and evaluating internal controls for SOX compliance.

ISACA

ISACA (Information Systems Audit and Control Association) offers guidance on IT governance and compliance through its COBIT (Control Objectives for Information and Related Technologies) framework.

NIST

The National Institute of Standards and Technology (NIST) develops cybersecurity standards and guidelines that, while designed for federal institutions, are widely adopted by organizations to establish effective compliance regimes.

ISO

The International Organization for Standardization (ISO) publishes globally recognized standards such as ISO 27001, providing guidance on implementing effective controls for information security, data protection, and IT governance.

SOX IT General Controls (ITGCs) and Security

SOX ITGCs are the bedrock of a SOX compliant environment. Essential processes including access control, authentication mechanisms, data protection, audit trails, environment segregation, change management, and backup and disaster recovery are all effectively managed when an organization adopts and implements one of the established IT governance frameworks such as COBIT or ISO 27001.

Simplify SOX Compliance with Purpose-Built Technology

Organizations should look for solutions specifically built to support SOX compliance, where systems monitoring is automated, mitigations and material changes have complete audit trails, and documentation is ready for SOX audits without manual effort.

Software and Tools for SOX Compliance

SOX compliance software includes Governance, Risk, and Compliance (GRC) platforms, enterprise resource planning (ERP) tools like SAP, and IT service management solutions. These tools support control monitoring, risk assessment, and reporting. Additionally, cybersecurity solutions like SIEM systems and identity governance platforms enhance security controls critical to SOX compliance (ISACA, 2021; Forrester, 2023).

SOX Compliance: A Continuous Control Environment

One of the biggest challenges of maintaining effective SOX compliance is its continuous nature. Once internal controls over financial reporting (ICFRs) are established, they require constant monitoring and improvement. Organizations must continuously mitigate existing risks, identify emerging risks, and implement updated control strategies.

The compliance process requires organizations to identify risks, implement mitigations, and document all relevant business transactions—a process that can be resource-intensive. While automation can significantly improve efficiency, selecting and implementing appropriate technology solutions requires careful evaluation and investment.

SOX compliance can be automated with in organization by implementing certain frameworks as below.

Risk Assessment Framework

Modern compliance platforms transform SOX adherence by integrating risk analysis directly into core business processes. This includes real-time evaluation of segregation of duties, automated scanning for sensitive access risks, and continuous monitoring of transaction patterns. Through automated risk scoring and impact quantification, organizations gain clear visibility into their compliance posture.

Continuous Control Monitoring

Automation enables real-time tracking of changes to critical configurations, master data, and transactions. The system continuously evaluates control effectiveness by monitoring user activities, analyzing transaction patterns, and flagging potential violations. This shifts compliance from periodic assessments to ongoing assurance.

Access Governance Automation

Modern platforms streamline complex access management through automated workflows. Key capabilities include risk-aware access provisioning, systematic certification campaigns, and privileged access monitoring. The system enforces compliant access lifecycles from initial provisioning through regular reviews and eventual deprovisioning.

Transaction Analysis

Advanced analytics capabilities transform how organizations monitor financial activities. The system can analyze 100% of transactions rather than samples, quantify financial exposure from control violations, and identify unusual patterns that merit investigation. This comprehensive view helps prevent material misstatements while reducing audit effort.

Control Documentation and Evidence

Automation fundamentally changes compliance documentation through systematic evidence collection and retention. The platform maintains detailed audit trails of all control activities, user actions, and system changes. This creates a complete, readily accessible record for internal and external audit purposes.

Cross-System Integration

Modern compliance platforms integrate across complex application landscapes including ERP systems, cloud services, and custom applications. This provides unified visibility and consistent controls across the entire technology environment that supports financial reporting.

Automated Reporting and Dashboards

Real-time dashboards and automated reporting capabilities provide clear visibility into compliance status. The system generates detailed evidence of control effectiveness, quantifies risks and violations, and maintains comprehensive audit trails. This transforms the preparation and execution of compliance audits.

This comprehensive automation approach typically reduces compliance costs by up to 70% while improving control effectiveness. The key is selecting a platform that aligns closely with your organization’s specific risks, existing systems, and compliance requirements.

SOX Compliance: Is It Worth the Cost?

Establishing SOX compliance in an organization can be costly, especially for small and medium-sized businesses. If an organization is not legally required to be SOX compliant, it can avoid expenses related to compliance audits. However, implementing an effective risk management program and establishing internal controls – both ITGCs and business process controls according to best practices – may prove valuable from a long-term perspective.

SOX Compliance FAQs

What Are SOX Controls?

SOX controls are mechanisms or processes designed to ensure accuracy and integrity of the financial reporting.

What Are the SOX Key Controls?

SOX key controls are related directly to protecting the integrity of financial reporting, while non-key controls are supplementary in establishing a compliance regime. The key controls may vary depending on the organization’s operational nature; however, access governance, data security and integrity, financial transaction reviews and approvals, and audit trails are normally considered key controls, while change management, business continuity (non-financial information backups and recovery procedures), physical security, IT systems maintenance, and compliance training programs are typically seen as non-key controls.

Why Did Congress Pass SOX?

The Sarbanes-Oxley Act was enacted to safeguard investors from fraudulent financial reporting practices and to ensure transparent and accurate disclosure of companies’ financial information.

What Are SOX Non-Compliance Penalties?

Penalties for non-compliance may include multimillion-dollar fines, stock exchange delisting, criminal charges, and imprisonment for executives, depending on the severity of violations.

How Does the SOX Act Apply to Employee Protection for Filing a Claim?

There are two sections of SOX dealing with whistleblower protection. Section 806 specifically protects employees of public companies, while Section 1107 establishes criminal penalties for retaliation against any person providing truthful information to law enforcement agencies.

What Are the Key Requirements of SOX Compliance?

SOX requires companies to establish and maintain internal controls over financial reporting (ICFR), obtain certifications from CEOs and CFOs attesting to the accuracy of financial statements, undergo external audits of both financial statements and internal controls, and retain all audit records and related documentation for seven years.

Put the Appsian Security Platform to the Test

Schedule Your Demonstration and see how the Appsian Security Platform can be tailored to your organization’s unique objectives

Internal SOX Controls: A Quick Overview

What is Internal SOX Controls?

The Sarbanes-Oxley (SOX) Act of 2002 was established as federal law to ensure accurate financial reporting by public companies and protect the intended users, such as lenders, investors, and government organizations, from financial statement errors and fraud and malpractice.

The Act includes 11 sections, out of which sections 302 and 404 are the most relevant to internal SOX controls. SOX section 302 defines the corporate responsibility for certifying the financial reports. Section 404, known as Management Assessment of Internal Controls, specifies requirements for maintaining and monitoring internal controls related to the company’s financial reports.

What is An External SOX Audit?

Section 404 requires businesses to have an annual audit of internal SOX controls performed by an independent external auditor. The purpose of the external audit is to enhance the degree of confidence of the intended users in the accuracy and completeness of the company’s financial reports, including balance sheets, income statements, cash flow statements, and statements of shareholders’ equity.

4 Key SOX Compliance Requirements

Any company that needs to comply with SOX must meet the following requirements annually. While each organization may establish its own compliance best practices, the ultimate goal is to meet four key requirements.

Management Responsibility:

SOX requires a company’s CEO and CFO to personally certify that all records are complete and accurate. Specifically, they must confirm that they accept personal responsibility for all internal controls and have reviewed these controls in the past 90 days. Failure to do so can result in heavy fines of millions of dollars and imprisonment.

Internal Controls:

The SOX act stipulates that public companies need to file a report that demonstrates the existence and efficacy of internal controls pertaining to financial records. Once again, SOX puts the burden of implementing these controls on the CEO and CFO to ensure the integrity and accuracy of financial information.

Data Security Policies:

Organizations that fall under the SOX act must create and implement data security policies that are designed to protect the storage and use of financial information. These policies should be communicated across the organization and enforced consistently to prevent financial inaccuracy or misinformation.

Proof of Compliance:

Companies are required to maintain and provide documentation that proves that all compliance requirements are being met. Also, all controls pertaining to SOX must be continuously monitored, tested, and recertified to measure SOX compliance objectives.

Impact of Internal SOX Controls on ERP Systems

Layered Internal Controls

The consistent implementation of internal controls mandated by SOX means that organizations must ensure adequate controls within all applications, including ERP systems. However, the role-based access controls provided by most ERP vendors are not fine-grained enough to demonstrate internal SOX controls.

To implement and demonstrate controls, organizations need to be able to implement layered access controls, often called defense-in-depth, that go beyond the initial point of access. Security teams must be able to monitor who is accessing what, when, and from where. This requires controls to be implemented at the access, transaction, and data field levels.

Even if you succeed in implementing these controls, SOX demands that these controls be continuously tested and monitored, making control recertification an integral part of your ERP SOX compliance process. And finally, your internal audit teams must be able to pull reports and logs that can undeniably verify the existence and efficiency of these controls.

Segregation of Duties Management

Segregation of Duties (SoD) is another aspect of SOX that affects ERP applications. Detecting and preventing SoD violations is vital to managing risk and fraud. When ERP admins need to manage thousands of roles and authorizations requests, there is a real risk of user over-provisioning and role conflicts that could lead to financial fraud. However, manually tracking each role and the resulting conflicts between roles is practically impossible.

To counter this challenge, automated SoD management solutions can be implemented across your applications. Automated cross-application SoD capabilities help you monitor role conflicts and SoD violations in real-time. They also manage your overall application risk from a single platform.

How Appsian Enables Internal SOX Controls in ERP

The Appsian Security Platform provides organizations with a range of controls and monitoring solutions that enable your security and compliance teams to not only implement internal SOX controls but also demonstrate their effectiveness at multiple levels.

Attribute-Based Access Controls

With Appsian’s ABAC capabilities, organizations can enhance their existing role-based access controls by taking contextual risk into account. For example, when users log into ERP applications, ABAC allows you to implement granular policies based on attributes like time, device, IP address, locations, etc. This information enables you to allow or deny access to sensitive information based on the context of access and significantly reduce data exposure in high-risk scenarios.

Adaptive Internal Controls

SOX requires companies to implement controls on access to and modification of data that affects financial reporting. Appsian enables internal controls at the ERP data field and transaction levels with tools like data masking and step-up multi-factor authentication for sensitive transactions. Coupled with Appsian’s ABAC capabilities, these layered controls can be activated based on contextual risk while allowing users full access when the risk is acceptable.

Automated SoD Management

Manually managing thousands of roles and authorizations while ensuring there are no SoD conflicts is a challenge for most organizations. Appsian automates SoD management by monitoring user activity and role usage in real-time. It pinpoints any current SoD violations of users and roles and prevents potential conflicts by testing roles in advance. Appsian’s cross-application capability also allows you to manage ERP risk with a single platform and implement SOX compliance consistently in all your ERP systems.

Learn how Appsian enables SOX compliance across your ERP applications with cross-application risk management, continuous controls monitoring, and adaptive internal controls. Schedule a demo with our ERP compliance experts.

Put the Appsian Security Platform to the Test

Schedule Your Demonstration and see how the Appsian Security Platform can be tailored to your organization’s unique objectives

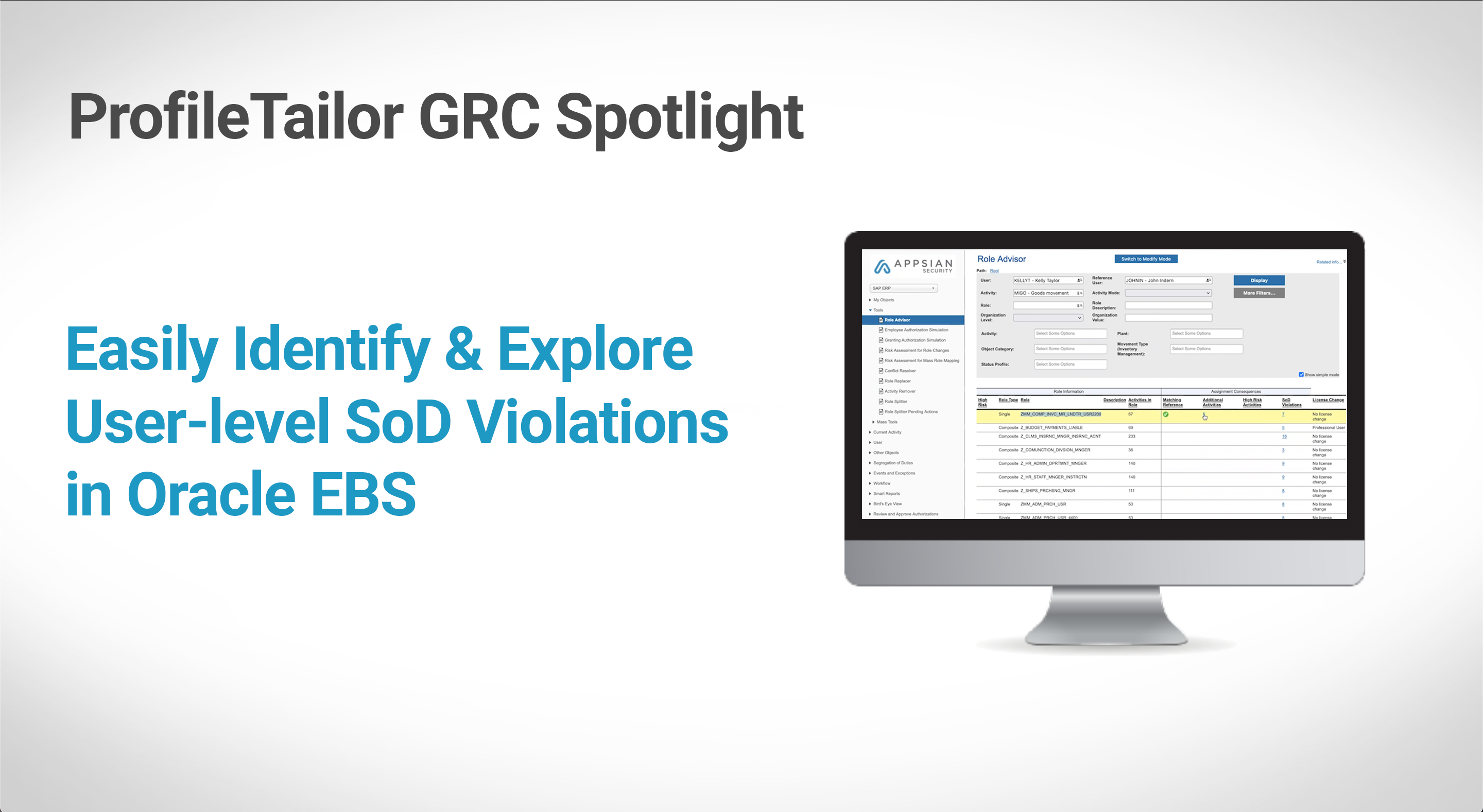

How Appsian Enhances SAP GRC with Cross-Application SoD & Risk Management

What is SAP GRC?

SAP Governance, Risk, and Compliance (SAP GRC) is a set of SAP solutions that enable organizations to meet data security and compliance standards. These solutions also provide control mechanisms to manage and mitigate risk. SAP GRC consists of four major components and multiple modules that manage risks, controls, identities, cyberthreats, and international trade across the SAP ecosystem.

What are the Components of SAP GRC?

SAP GRC features four major components that unify enterprise risk and control activities on a single technology platform. Each component has a set of modules that serve a specific function. As a whole, SAP GRC solutions give decision-makers the insights needed to adjust strategies and objectives while enabling them to predict, detect, and respond to business threats and opportunities. The four core components include:

Enterprise Risk and Compliance

Modules: SAP Risk Management, SAP Process Control, SAP Financial Compliance Management, SAP Business Integrity Screening

Cybersecurity, Data Protection, and Privacy

Modules: SAP Enterprise Threat Detection, SAP Privacy Governance, SAP Data Custodian

Identity and Access Governance

Modules: SAP Access Control, SAP Cloud Identity Access Governance, SAP Identity Management, SAP Single Sign-On

International Trade Management

Modules: SAP Watch List Screening, SAP Global Trade Services

Enhancing Your SAP GRC Capabilities with Appsian

While SAP GRC is a good tool to implement GRC across your SAP systems, it has certain noteworthy limitations. Appsian’s GRC solution goes beyond the SAP ecosystem to provide unprecedented visibility of real-time authorization usage and implement fine-grained, adaptive controls across applications. This significantly improves security while reducing fraud, risk, and exposure to sensitive data at an enterprise level. In addition, Appsian can be deployed as a stand-alone solution or combined with your existing SAP GRC solution to enhance security and risk management.

Here are some of the ways Appsian can enhance your GRC capabilities.

Cross Application Connectivity

Most companies utilize multiple ERP platforms for their business operations. Though SAP GRC offers a range of modules and controls, it can be deployed only within other SAP applications. Appsian integrates with several business applications like Salesforce, Workday, Oracle, Microsoft, Infor, or industry-related applications without any third-party connectors. Appsian GRC seamlessly connects all your applications to a centralized system for unified GRC management.

Attribute-Based Access Controls

Many ERP applications, including SAP, offer only role-based access controls. While role-based access works well when the user connects through a secure network like the office, today’s workplace demands a more adaptive approach to access controls. Appsian utilizes contextual attributes like location, device, time, IP address, and more to determine access risk and allows security teams to implement policies based on these attributes. Additionally, unlike role-based authorizations that are granted at access, Appsian’s fine-grained controls go beyond the point of access down to the data field and transaction level to deliver layered security, enhanced compliance, and improved user governance across multiple applications using a single control platform.

Authorization Management

As new users are added, and existing users are granted more roles, it becomes increasingly difficult to track and manage user authorizations, especially when dealing with multiple ERP applications. The result is user overprovisioning that creates greater data exposure, SoD conflicts, and overall risk. Appsian tracks authorization usage to recommend the elimination of unused and underused authorizations and access rights, making the monitored applications safer and simpler.

User Monitoring

While SAP GRC allows you to monitor and manage identities and control who has access to information, it provides little insight into what authorized users are doing within the applications. Appsian enables you to know what your users are doing, what tables they are accessing, what changes are being made, and by whom. It provides a detailed report of user activity data and allows you to set up alerts when sensitive information or tables are accessed.

Identification of Irregularities

The ability to continuously monitor user activity across applications also allows Appsian to track each user to identify and compare authorizations within each department or business unit for any discrepancies. The solution sends a notification to the management team of any suspicious activity that needs further investigation. However, the lack of user monitoring in SAP GRC means that such irregularities go unnoticed.

Impact on Licensing Costs

It is well-known that SAP licenses do not come cheap. Additionally, SAP does not provide a clear view of user roles and licenses. This makes it difficult to understand the cost impact of granting new roles/licenses to users. Appsian’s GRC solution considers licensing costs when recommending the best role to grant users by attaching costs to authorized roles and suggesting a less costly role when available. This allows you to manage your SAP license costs better and avoid overprovisioning.

Appsian’s enhanced approach overcomes the limitations of traditional SAP GRC, enabling you to manage identities, access, authorizations, and risk across multiple ERP platforms. Schedule a demo with our ERP GRC specialists to learn more about our GRC capabilities.

Put the Appsian Security Platform to the Test

Schedule Your Demonstration and see how the Appsian Security Platform can be tailored to your organization’s unique objectives

How to Reduce SoD Conflicts in SAP for Effective SOX Compliance

With several large public companies deploying SAP applications for their financial and accounting operations, ensuring SOX compliance within the SAP ecosystem is crucial for a successful audit. Segregation of Duties (SoD) in SAP plays an important role in managing roles and authorizations among SAP users to prevent conflicts and mitigate the risk of fraud.

However, user access to SAP systems is dynamic in nature due to constantly changing roles, making it challenging to track, detect, and prevent SoD conflicts. Unfortunately, SAP’s security/access management capability is static, preventing a risk-adjusted adaptive security approach recommend by Gartner. In the context of SAP, SOX compliance demands that organizations also implement an effective monitoring, alerting, and prevention mechanism for fraudulent activity arising from SoD conflicts.

How SOX Affects Internal Reporting and Controls

The Sarbanes-Oxley Act has two sections that address requirements for evidence of effective internal controls over accounting and financial reporting – sections 302 and 404. Section 302, titled: Corporate Responsibility for Financial Reports, states that the CEO and CFO are directly responsible for the accuracy, documentation, and submission of all financial reports as well as the internal control structure to the SEC. That act mandates the CEO and CFA to confirm that they accept personal responsibility for all internal controls and have reviewed these controls in the past 90 days.

While SOX section 302 defines the internal controls affecting accounting and financial reporting, SOX section 404, titled Management Assessment of Internal Controls, specifies requirements for monitoring and maintaining internal controls related to a company’s accounting and financials. Section 404 is the most complicated, most contested, and most expensive to implement of all the Sarbanes Oxley Act sections for compliance.

The Role of Access Controls for SOX 404 Compliance

Access Controls are intended to effectively manage the inherent risks associated with managing access to systems and data. These risks include segregation of duty security violations, granting excessive access, ineffective access change management process, ineffective access termination process, ineffective access review and recertification process, and poor password enforcement, to name a few.

According to Audit Standard # 5, if these types of access risks are not effectively controlled, the external SOX compliance audit will report a control issue. Control issues are ranked as a control deficiency, significant control deficiency, or worst of all, a material level control weakness. Appsian ProfileTailor GRC helps organizations effectively manage the entire SAP access management lifecycle to monitor and manage the internal control requirements of SOX sections 302 and 404.

What is SoD Conflict in SAP?

Segregation of duty conflicts and SoD security violations are associated with inappropriate access at the SAP transaction workflow level. For example, an SAP user may have access to create a new vendor, create a vendor payment, and authorize that vendor payment. These three access functions should be appropriately segregated between different people because it can lead to fraud. SoD conflicts in SAP arise when user roles and the authorisations associated with those roles are not clearly defined. This leads to user over-provisining with users gaining more authortizations than required as per company policies and compliance regulations.

Overcoming SoD Conflicts in SAP for Effective SOX Compliance

To avoid access risks like SoD security violations and achieve SOX compliance in SAP, organizations need to implement the following layers of controls:

Establish effective governance and oversight of the SAP security administration process, which includes defining roles, responsibilities, policies, processes, procedures, etc., and monitoring the performance of SAP security to identify and correct performance variances quickly. Governance is often one of the most overlooked processes, and often significant SAP security administration issues occur that could have been avoided.

Establish an effective SAP security administration process for adding new users, modifying access of existing users, terminating user access in a timely manner, and performing periodic reviews of all user access for recertification. Leveraging automation, analytics, and artificial intelligence can dramatically improve the operating efficiency of the SAP security administration process. Leveraging an attribute-based access control (ABAC) security model provides more effective and adaptive security than the role-based access control model native to SAP. Additionally, ABAC can automate your SAP policy enforcement at the business process, transaction, and data level.

Internal auditors should perform an independent audit of SAP security to verify the design and effectiveness of all SAP access controls after the business unit and IT department perform their own self-assessments.

Appsian ProfileTailor GRC is a comprehensive compliance platform that enables greater control over user access risks, segregation of duties, compliance, and audit. The platform leverages embedded AI, machine learning, and predictive analytics to continuously identify potential risks and provide optimized suggestions to resolve conflicts. With Appsian, your organization can achieve SAP SOX compliance by:

- Establishing effective layers of control in governance and oversight

- Automating security administration procedures

- Implementing AI and ML empowered access risk analysis & recommendations

- Automating policy enforcement with ABAC

- Effectively monitoring and reporting with real-time analytics

- Addressing SAP security challenges with self-assessment and independent audit capabilities

Get in touch with our SAP Compliance Experts to achieve and maintain a clean SAP security environment.

Put the Appsian Security Platform to the Test

Schedule Your Demonstration and see how the Appsian Security Platform can be tailored to your organization’s unique objectives